Setting up a payment gateway is crucial for businesses looking to streamline transactions, especially in an increasingly digital marketplace. Razorpay is one of India’s leading payment gateways, offering seamless integrations and supporting various payment methods.

However, before activating your account and using Razorpay, you must meet specific documentation and KYC (Know Your Customer) requirements.

In this guide, we’ll explore the complete list of documents required for Razorpay payment gateway activation, the steps involved in the process, and a few tips to ensure smooth onboarding.

Why Choose Razorpay?

Razorpay offers extensive payment methods, including UPI, credit/debit cards, and wallets, enabling businesses to accept domestic and international payments. The platform is ideal for small to large companies, offering features like real-time tracking, fast settlements, and a user-friendly dashboard.

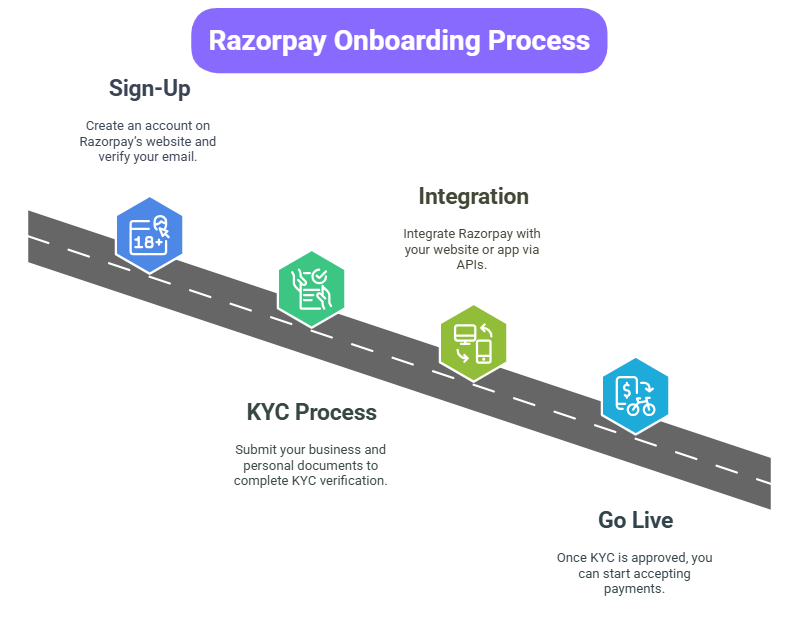

Step-by-Step Process for Razorpay Onboarding

Before delving into the document list, here’s a simplified view of the onboarding steps:-

- Sign-Up: Create an account on Razorpay’s website and verify your email.

- KYC Process: Submit your business and personal documents to complete KYC verification.

- Integration: Integrate Razorpay with your website or app via APIs.

- Go Live: Once KYC is approved, you can start accepting payments.

Let’s focus on the second step: the KYC documentation.

KYC Documents Required for Razorpay Payment Gateway

The documents needed for KYC verification depend on the type of business entity you operate. Below are the requirements for different categories:

1. Private Limited, Public Limited, and LLP Companies

| Proof Required | Supporting Documents |

|---|---|

| Proof of Business Identity | Certificate of Incorporation |

| Proof of Business Existence | Income Tax Registration (Company PAN Card) |

| Proof of Identity of Business Owners and Authorised Signatory |

|

2. Sole Proprietorship

| Proof Required | Supporting Documents |

|---|---|

| Proof of Business Identity and Existence |

|

| Proof of Business Working |

|

| Proof of Identity of Business Owners | Income Tax Registration (PAN Card) |

| Proof of Address of Business Owners | Government-approved identity and address proof of Proprietor (like Aadhaar Card/Voter Card/DL/Passport) |

3. Partnership Firms

| Proof Required | Supporting Documents |

|---|---|

| Proof of Business Identity | Registered Partnership Deed |

| Proof of Business Existence | Income Tax Registration (Company PAN Card) |

| Proof of Business Working |

|

| Proof of Identity of Business Owners and Authorised Signatory |

|

4. Individual/Unregistered Businesses

| Proof Required | Supporting Documents |

|---|---|

| Proof of Identity of Business Owners and Authorised Signatory |

|

General Requirements for All Entities

Regardless of the business type, the following documents are typically required:

- Company PAN Card: For tax purposes and business verification.

- Authorised Signatory’s KYC Documents: PAN, Aadhaar, Passport, or Voter ID.

- Business Address Proof: Utility bills or lease agreements, ensuring the address matches the business details.

Suggested Read:

Razorpay Documentation: Best Practices

To ensure your KYC process is smooth, follow these guidelines:

- Document Format: Ensure all documents are clear, unblurred, and uploaded in either PDF, JPG, or PNG formats.

- File Size: Each document should be under 5 MB to ensure a quick upload.

- Ensure Consistency: The address on the documents should match your business registration details.

- Business Bank Verification: Ensure the current account name matches the business’s registered name.

Common Issues During KYC

- Mismatch of Documents: If the name on the PAN card doesn’t match the business name or authorised signatory’s name, your verification may be delayed.

- Unclear Documents: Razorpay might reject documents that are blurry or hard to read.

- Incomplete Documentation: Double-check the required document list to ensure you’ve uploaded everything needed.

Activation Timeline

Once the documents are submitted, the verification process generally takes 1-3 business days. You can check the status of your application on the Razorpay dashboard under the KYC Verification section. Once verified, you can begin integrating Razorpay into your website or app.

Razorpay’s International Payment Support

If your business plans to accept international payments, Razorpay offers options to display prices in over 90 currencies and supports international credit/debit cards. To enable this feature, an additional KYC verification may be required.

Razorpay offers a highly secure, user-friendly platform for processing payments, but completing KYC verification is mandatory. Ensuring that all the necessary documents are submitted clearly and correctly, you can speed up the process and start accepting payments in no time. Keep a close eye on your Razorpay dashboard for any updates or requests for additional documents. Following these guidelines, you can easily integrate Razorpay Payment Gateway with your website or app.

Frequently Asked Questions

What documents are required for Razorpay KYC?

The documents required depend on your business type but generally include the following:

- Business incorporation certificate.

- Business PAN card.

- Address proof and identity proof of the authorised signatory.

How long does the Razorpay KYC process take?

What is the role of a PAN card in the Razorpay KYC process?

Can I change my documents after submission?

Yes, if there is a mistake, you can upload the corrected documents on the Razorpay dashboard before the verification is complete.

Is there additional documentation for international payments?

If you wish to accept international payments, you may need to provide additional verification documents like bank statements or proof of business presence abroad.